Market Review: March 08, 2024

Crypto seems to be on an an unstoppable run in recent days. Are we starting to enter the euphoria phase of the market? Well, the fear

Crypto seems to be on an an unstoppable run in recent days. Are we starting to enter the euphoria phase of the market? Well, the fear

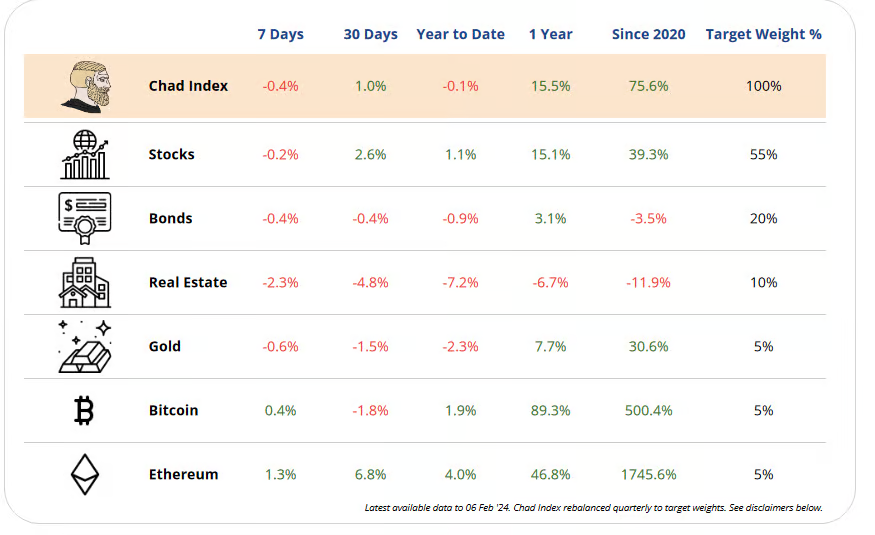

Bitcoin and Ethereum rise; ETH’s surge seems sentiment-driven. Supply drop hits $85M. REITs and Gold gain amid FED rates. NVIDIA’s earnings draw attention; TSMC, ASML see minor losses. Citi predicts commodity surge amid geopolitical tensions. Houthi blockade raises export concerns.

Cryptochads rejoice as Bitcoin surpasses $50,000 fueled by BlackRock and Fidelity ETFs. Stablecoins surge. Ethereum and Solana gain. Commodities deflate due to oversupply in China.

REITs face a 15.8% median discount; data centers thrive. Ethereum’s Dencun Upgrade boosts scalability. U.S. Treasury auctions $42B in bonds. Ford triumphs, NY Community Bancorp downgraded to ‘junk’ by Moody’s.

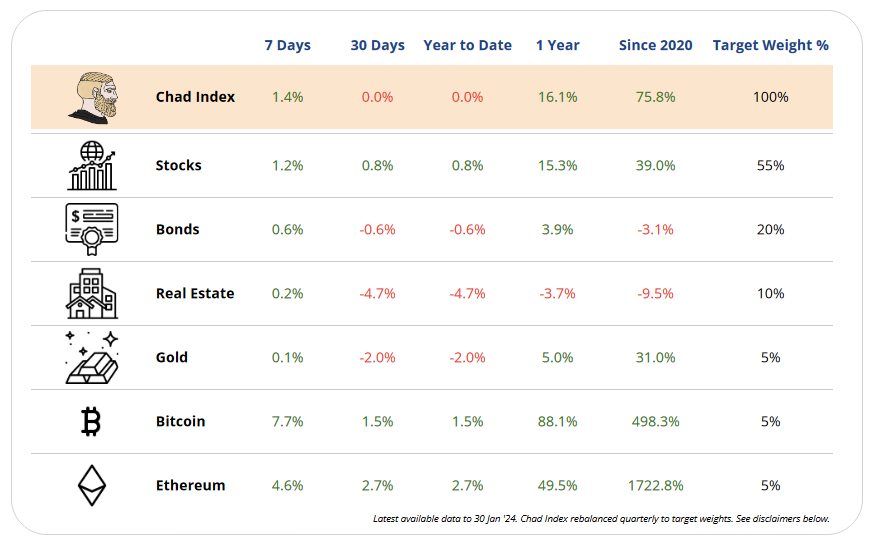

January ended on a positive note with Bitcoin reclaiming $43K. Ethereum surged amid optimistic SEC views. Crypto Fear and Greed Index leans Greed. META shines in stocks. Watch out for BTC Halving and FED rate cuts. A familiar rhyme in the market?

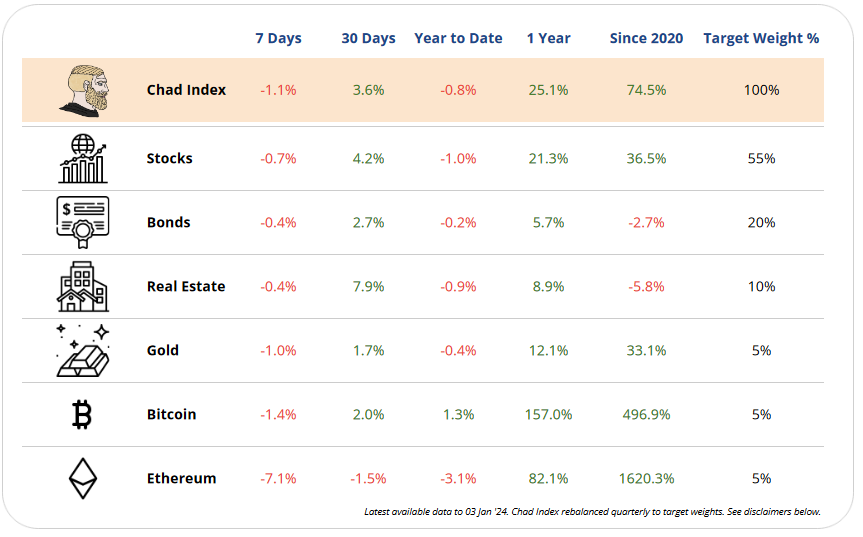

SEC hints at delayed rate drops, affecting optimism. Bitcoin disappoints post-ETF approval, profit-taking prevails. Ethereum bucks trend, SEC eyes ETH ETF approval. Stay wary of “buy the rumors, sell the news” dynamics.

Portfolio hit as Nasdaq giants Apple, NVIDIA stumble on downgrades and trade restrictions. Gainers: Chevron, Disney; losers abound amid Fed uncertainty. Crypto takes a hit; blame game on Matrixport’s ETF forecast and contrasting Cramer sentiments. Volatility reigns!

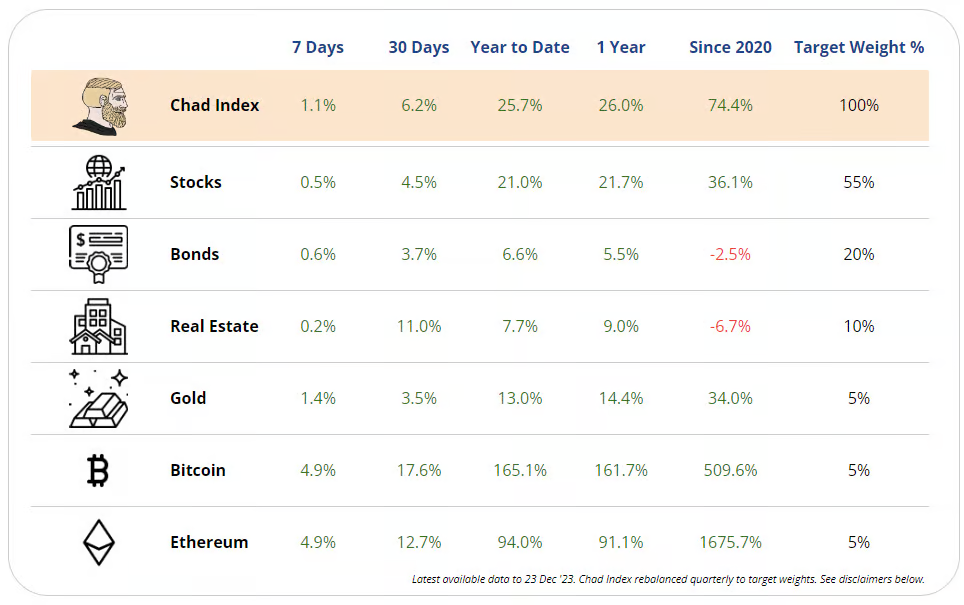

Xmas for investors as all asset classes surge. FED signals rate stability, even potential cuts. Crypto stars Bitcoin, Ethereum, and Solana shine. Solana’s staggering 900% growth in 12 months propels it to 4th-largest crypto. Unexpected turn for ‘Soylana’ challenges perceptions. The Chad Index expands?

Markets had a strong week with stocks, crypto, and various assets performing well. Investors anticipate the FED avoiding rate hikes, fostering a positive environment for risk assets.