🥴 NOT THE BEST START TO THE YEAR

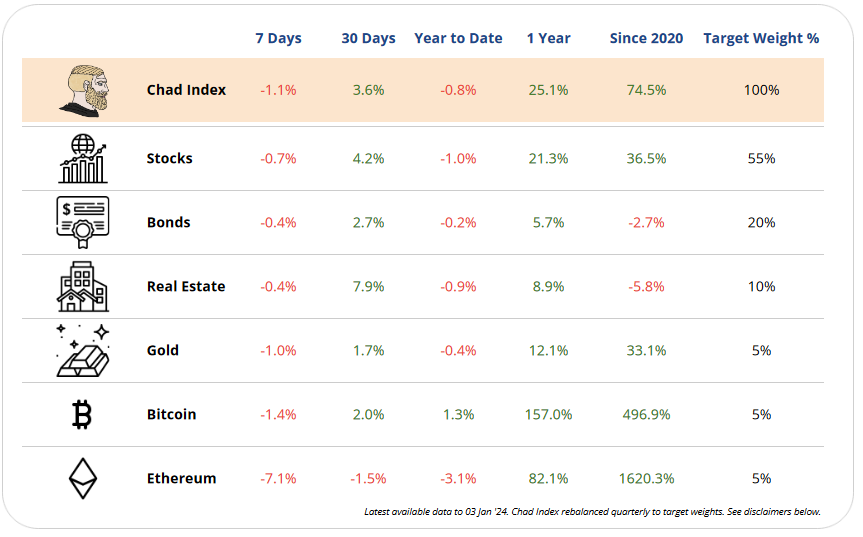

Ouch. Our portfolio bled on all fronts this past week.

The Nasdaq index received a big punch in two of its biggest constituents: Apple and NVIDIA.

Barclays downgraded Apple after weak iPhone sales. And the Dutch government blocked ASML Holding of shipping to China. This hurt NVIDIA and other semiconductor related companies, such as AMD and OnSemi.

On the flip side, biggest gainers were oil giant Chevron, powered by rising oil prices. Disney and pharmaceutical companies also did well.

However, most stocks suffered losses. Some speculate this is because, although the FED is showing signs of wanting to cut rates, it has not been clear on neither when nor how it will happen.

The Crypto market was a bloodbath, but who’s to blame for it?

Well, we aren’t someone to point fingers, but crypto-services platform Matrixport seems to be the one to blame. They published a market forecast report saying that the SEC won’t be approving any Bitcoin ETFs anytime soon.

Others say it is because Jim Cramer was bullish on Bitcoin. The internet joke is that with anything he says you should do the opposite.

It is so painfully accurate!

Not the best start to the year. But worry not, we’re just getting started.